Reading time: 8 minutes

This post may contain affiliate links. If you click these links and purchase something we may earn a commission. This helps us provide the information here free of charge to you.Continue Reading.

As the year 2021 has approached, all of us are geared up for the year, and we have high hopes for financial resolutions for the new year. We all have been making resolutions for this year but are you even adulting if you are not worried about your debts and finances.

We hope every year that we will get all our finances in shape this year, but we fail. In today’s blog, I will be sharing with you 13 financial resolutions for the New Year. Stick to them, and I am sure you will get into the best financial state you have been in the past years.

1. Calculate Your Net Worth While Going for Financial Resolutions for the New Year

For the first things, you need to calculate your net worth. Many people are not aware of their net worth. When you know the approximate amount you are earning, you will learn how much to spend. This might not seem a great help to you right now, but once you get to it, you will see that it will automatically regulate your expenses.

2. Create A Budget on a Financial Planner

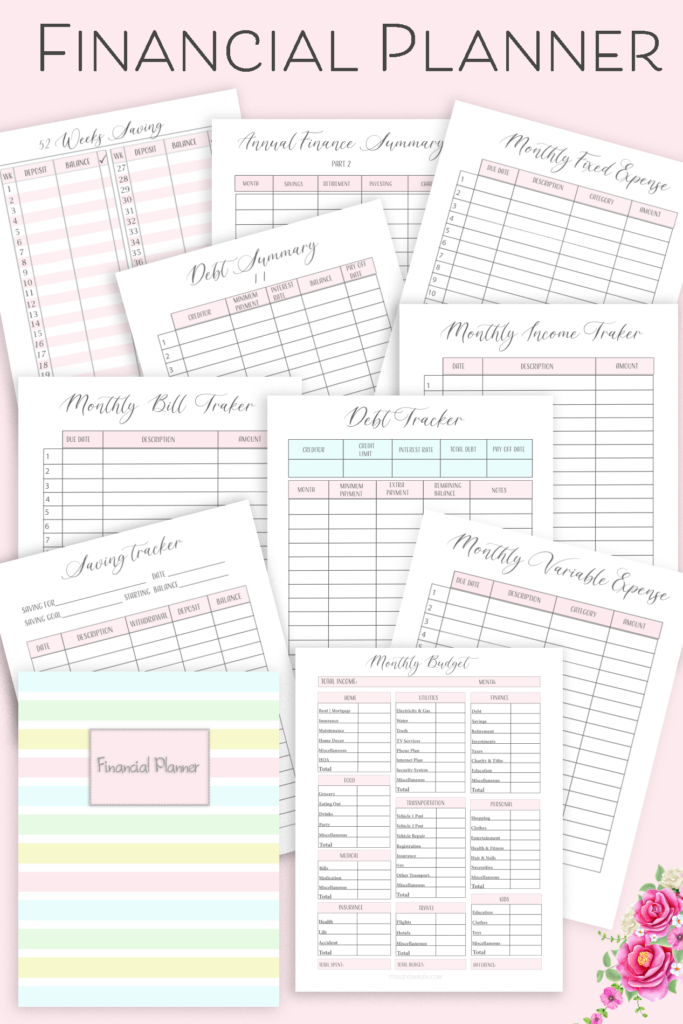

Having a budget and plan is constricting for some people, but you will see that you can spend a lot better and in more productive places than you had already been spending when you start following a budget.

The main purpose of having a budget is to write down your fixed expenses like phone bills, groceries, savings, mortgage, rents, credit card bills, electricity bills, and other bills.

After that, you will have the rest of the money for the month to spend the way you want. You can have enough money left to spend on the rest of the flexible expenses like restaurants and clothing without any guilt of overspending because you will already be having a budget.

You can use a New Year financial resolution planner to write down all your financial resolutions on that. Writing them down makes it easier to follow because you will have a clear plan in front of you.

3. Save Up Some Money For Emergency

Besides saving up for something you will buy, you should save up some money for any emergency. God forbid, but who knows when you get to spend on something you were not expecting at all.

You can get into an accident. This way, you will have to pay for the hospital fees, if any, and also for the repair of your car. It can be cumbersome in the pocket if you have to spend so much money all at once. It is better that you have some money already saved up for such situations.

4. First Spend Money On Essential Big-Ticket Items

You have to get the roof repaired or have your house painted that month, you have it written in your budget, but by the end of the month, you run out of budget.

Such big-ticket expenses should be things you should prioritize first on things you will be spending because, at times, the cost can be a little more than the estimated one. So if more money is used up, it is alright because you can compensate for it with the other things and keep it all within budget.

5. Save More

Let’s make it this year’s top financial resolution for the New Year that you will be saving a little more. You have no idea that just saving up a few dollars each month will make a lot of difference in your annual savings.

If you feel like that you will not save up much and it is difficult for you to cut up expenses, start from saving up fifty dollars each month and then move to more. Set a goal where you want to get by the end of the year and add more to your savings each month. Eventually, you will reach your desired amount.

6. Improve Credit Score

It is quite common among young people that their credit scores are not up to the mark, and it can be difficult for you in the future when you are getting to real estate purchasing and all that stuff.

Make it a financial resolution for the New Year to improve your credit score. A good credit score is above 700. You can improve it by paying all your bills on time through the credit card, paying off all your debts through it, cutting off your expenses, and not paying too much through the credit card.

7. Try Paying Off A Credit Card

Paying through a credit card can be very convenient, but sometimes all of this mounts up, and it has an impact on your credit score. So try paying off a credit card.

If you already have a debt on your credit card, you can get away with it in a few months if you start paying off a credit card. Many people have opted for this and if you are already not at it, make it a goal to try to pay off a credit card this year.

8. Clear All Your Balance Each Month

If you think that just a few dollars on your credit card will do no harm and you will clear this balance the next month, but you have no idea what you are signing up for because once you start having a balance on your credit card, it will mount up to so much money within a few months.

You can start up by clearing all your balances each month on your credit card. If you have a balance on your card, it will add up more interest in your debts and harm your credit history. Clear all the expenses you have on your credit card each month, and gradually your credit card history will also clear up.

9. Pay All The Debts On Time

Managing your debts is not too hard. An easy thumb rule to keep in mind when managing your debts is that make sure all of them are below 36% of your pre-tax income. You will quickly pay them within your budget if you do not let them exceed this amount.

Also, with managing comes paying your debts within time. You cannot put them off because it will add interest to it as you delay the payment. It will make it more expensive well as it will harm your credit score.

10. Keep Checking On Credit Card Report

When you have just started with debts, you might most likely mess up your credit score, but it will keep mounting up if you do not keep a check on it.

You should always be aware of how your credit score will manage your debts according to it. There are many credit bureaus — Experian, Equifax, and TransUnion, which give you a credit report, and they also keep in check your credit score. You should get a credit report after every three to four months. Don’t get too many credit reports.

11. Try Not To Open Anymore Credit Cards

More the credits cards more will be the fuss about managing debts, payments, and money. It depends on you how many credit cards will be enough for you, but too many credit cards are not good.

When you apply to get a credit card, they bring up all your credit history, and having it checked too many times will harm your credit score. On average, four credits are more than enough. So make it a financial resolution for the New Year not to have too many credit cards.

12. Pay The Taxes

Before we move to the payment of taxes, let us talk about the places where you can save up on the taxes. There are a few real estate investment trusts and other such departments which have too much tax, so try not spending here. ETFs and municipal bonds are tax-efficient places. Anyhow, pay the taxes that are due to you by the government because this is each citizen’s responsibility, and not paying them can get you into serious trouble.

13. Consider Getting Insurance

Whether it is health insurance or life insurance, you are never too late to get one, and no age is too early for them. You never know when you might get any disease, and medical treatment is costly when you don’t have medical insurance. You should make sure you are insured medically.

There is a drastic difference in hospital fees if you are insured. Also, life insurance companies help you save up for your family members because you never know when your life might end, so you have to think about the dependent people. Not only that, but these life insurance companies help you after retirement and if you get unemployed.

Conclusion

Adulating can be very hard for money, but it can be effortless if you learn how to spend your money the right way. Set your priorities and goals the right way, and I am sure you will shape all your finances.

These are the 13 Financial Resolutions for the New Year you can set for the New Year 2021, and they will help you a lot. You don’t have to rush towards it. Take one step at a time, and by the end of this year, you will get all your finances sorted.

Let me know what your financial resolutions are in the comments section below.

.